Q1.

| Year | Project A | Project B | ||

| 0 | -200 | -200 | ||

| 1 | 80 | 100 | ||

| 2 | 80 | 100 | ||

| 3 | 80 | 100 | ||

| 4 | 80 | |||

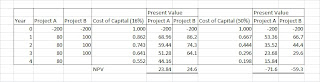

a) If the opportunity cost of capital is 11%, which of these project ts is worth pursuing. Use both IRR/ NPV for calculation.

(Click picture to enlarge)

Answers using financial calculator:

IRR - A= 21.86%, B=23.37%

NPV - A= 48.1956, B=44.37147

b) Suppose you could only choose one project, which project would you choose?

- Project A, because of higher NPV

c) Which project would you choose if the opportunity cost of capital is 16%. Use both IRR/ NPV for calculation.

Answers using financial calculator.

IRR - A=21.86%, B=23.37%

NPV - A=23.85%, B=24.59

-Project B because higher NPV

d) What are the internal rates of return of projects A & B?

e) Based on your answers above, is there any reason to believe that the project with the higher IRR should be chosen?

- Project B, because IRR of Project B is more than Project A. Therefore Project B has a much better chance of growth.

f) If the opportunity cost of capital is 11%, what is the profitability index for each project? Does the profitability index ranks the project correctly?

- Profitability index = NPV / Initial investment

PI for Project A = 48.24/ -200 = -0.2412

PI for Project B = 44.4/ -200 = -0.222

- Yes

g) What is the simple payback period of each project?

- Project A - 200/80 = 2.5 years

- Project B - 200/100 = 2 years

Q2. Luxury Home Furniture is considering two independent projects that have initial investment of RM120,000 and RM96,000 respectively. The projects' estimated cash flows are summarized below

a) Luxury Home Furniture's current investment policy is to accept only projects that are recoverable within 3 years. Calculate the discounted payback period if the cost of capital is 10%. Advise the company in which project to invest based on payback period.

(Click picture to enlarge)

Payback for A = 3 + (672/ 24588) = 3.03 years

Payback for B = 2 + (21636/ 27036) = 2.8 years

b) Calculate the NPV for project A and Project B, if the required rate of return of the company is 12%.

c) Calculate the Internal Rate of Return of both projects.

No comments:

Post a Comment